Receiving multiple OTPs on your phone? Here’s what you should do next!

A major push toward the digital economy is a great boon. But, entering the digital world comes with many drawbacks you can never imagine. Digital adaptation has made it easy to transact online without any fuss and limits the amount of Physical cash that one has to keep ready in their pocket. With digital modes of payment, you can transfer or receive money, pay your bills, or make online purchases just by simply scanning the code. Scammers are becoming more advanced and active than ever before, and receiving multiple OTPs on your phone is the latest method of duping customers.

The wheels of e-commerce platforms, digital modes of payment, online banking, and online shopping are reliant on OTPs to authenticate their customer transactions. With the latest cyber security threats taking place in the digital world, companies, and organizations are adding new safety and security measures to their existing arsenal, and OTPs are the latest ones that have gained immense popularity within a short time.

What is an OTP?

OTP stands for One Time Password! It is a time-bound password that can be used only once. Unlike, user-generated passwords, OTP adds an extra layer of security between people and the organization.

Let’s suppose, when you are logging in to a banking app by entering your username and password, you are receiving a security code. Though the username and the password are the same, every time you try to log in, you receive a different security code. This process makes sure that no stranger who has stolen your ID and password cannot log in to your bank account.

Why I am receiving multiple OTPs?

Receiving multiple One-Time Passwords (OTPs) on your phone can have several possible explanations. Here are some common reasons:

- Account activity: If you are actively using multiple online services or platforms that require authentication, such as banking apps, social media accounts, or shopping websites, you may receive multiple OTPs from each of them when you log in or perform certain actions.

- Phishing attempts: In some cases, you might receive bulk OTPs due to phishing attempts. Hackers or scammers may try to gain unauthorized access to your accounts by pretending to be a legitimate service and sending fake OTPs. If you receive bulk OTPs from unknown sources or for services you haven’t used, be cautious and avoid entering those OTPs anywhere as it can be dangerous!

To stay safe from rising Phishing Attacks, read our blog

- Account recovery or password resets: When you initiate a password reset or account recovery process for a particular service, they may send too many OTPs to ensure the security of the process. This is often done to verify your ownership of the account and to prevent unauthorized access.

- Technical issues: Occasionally, technical glitches can cause OTPs to be sent multiple times. It could be an error on the server side or a network issue. If you consistently receive multiple OTPs from a single service, it’s worth contacting their customer support to investigate the matter. Sometimes, it might happen that OTPs don’t come due to congestion in the network and when you go back in the network, you receive multiple OTPs at once but show different timings. However, there is no need to worry!

- SMS routing or delivery delays: Sometimes, delays in SMS routing or delivery can result in receiving OTPs in a batch. Network congestion or issues with your mobile service provider can contribute to such delays.

Well, let’s understand this with another example!

Meet Priya, an old employee at ABC Company who shops online often. One day, she received an order from a shopping website. The delivery man came and gave her the parcel and asked for money. She refused to take the order and said the package was not ordered by her and she didn’t give the money.

Now, the man pretends that he cancelled the delivery. To confirm this, the man tricked the girl and asked her for an OTP. Well, the girl without even thinking or reading the message shared the OTP with the delivery man. Ultimately, after inserting the OTP, the delivery man hacked her phone and later stole all the money from her account. She lost years of hard-earned money on just a single share.

Moral of the story: Just like you think twice before opening your house’s main door to stop any unknown person, you need to think twice or thrice before sharing any OTP with an unknown person as it can be malicious. The scammers are smart enough to keep an eye on customers who frequently shop online!

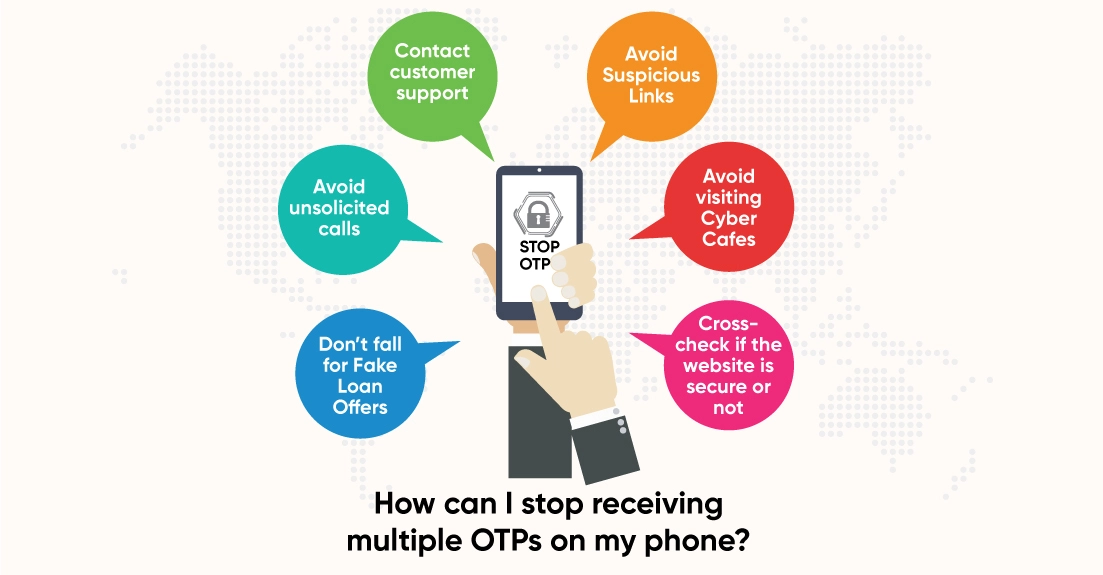

How can I stop receiving multiple OTPs on my phone?

Staying alert, aware, and informed is the first line of defense that you can look forward to if you want to stay away from OTP fraud.

- Contact customer support: Contacting customer support is one of the best ways how can you stop receiving bulk OTPs on your phone. If you continue to receive bulk OTPs despite adjusting your account settings, it’s advisable to always contact the customer support of the respective service or platform from where you are receiving the OTPs. They can provide you with their support & guidance and further assist you in resolving the issue.

- Avoid Suspicious Links: Many data farming companies out there their customer’s email addresses and phone numbers to third parties with an aim to generate maximum leads. Hackers steal the data from these companies to obtain personal information about the clients. Once they receive the data of the targeted clients, they start shooting too-good-to-be-true emails such as pre-approved loan offers, credit card offers, and many more. If you ever receive this kind of email and click on the link shared, not only you’ll compromise your identity but also pave an easy way for the Malware to enter, thereby giving fraudster’s easy access to your confidential data.

- Avoid unsolicited calls: Nobody is safe in this digital world. Your data is revolving between hackers! These hackers collect your personal information such as your date of birth, email address, and phone numbers, or hack your social media accounts.

Suppose you get a call from an unknown number saying that they are calling you on behalf of the bank and telling you that they need to update your KYC details in the database and for this, they need a few details. If you agree to whatever they said, they will ask you to download an app that gives them easy access to your device. By keeping you busy on the call, they will capture the one-time OTP password to transfer a large amount of money from your bank. So, it’s always better to avoid sharing any sensitive information, unless you’re 100% sure that this call is from a genuine or a known person.

- Avoid visiting Cyber Cafes:

Going to a cyber café to get your Aadhar updated or to fill out any online forms for a job or for further studies is a blunder that many people commit. But, do you know that these places are highly vulnerable to data breaches and the best location for hackers to trap people? So, the next time you are planning to visit a cyber café to fill out a form, please stop as it may be a dangerous choice!

- Don’t fall for Fake Loan Offers: On the play store, there are certain apps for payment and loan purposes that exist only to steal your sensitive data.

Let’s have a look at what happened to Sanjana

Sanjana, a working professional recently applied for a personal loan from a reputed bank. She completed the entire application process through the bank’s app and was waiting for the disbursal amount. Amidst the detail, she received a call from someone who claimed to be a bank representative. The caller asked Sanjana to share the OTP to complete the disbursal process. Sanjana shared the OTP without even thinking once with the caller without even thinking once & made the biggest mistake.

She later received a message from the bank that the loan amount has been credited to her account and she can withdraw the same. However, after that, she got another email informing her that the entire amount has been debited. One small mistake and a big Loss! The caller with whom she shared the OTP withdrew the entire amount from her bank account!

- Cross-check if the website is secure or not: Always make sure that you are browsing a secured website. Cross-check if the website starts with HTTPS or HTTP. The ones with an “S” are considered to be more secure and safe as compared with the ones without an “S.” The more secure the website, the less will be the chances of scammers stealing your personal data and OTP frauds.

To Conclude,

“A little caution and you are saved from a big financial loss!”

OTP frauds are becoming increasingly common! Reading the above examples will help you understand what it is and how you need to be cautious if you don’t want to get trapped. There might be some people who experienced the same situation as mentioned above.

What you can do from your end is to avoid responding to any scam emails, clicking on suspicious links, attending unsolicited calls, or sharing your personal information online.

Disclaimer:

The views expressed in the blog are of the blogger and do not necessarily represent or reflect the views written on the website.

Bettie

Wow, fantastic weblog layout! How long have you ever been blogging for?

you make running a blog look easy. The full look of your site is excellent,

as smartly as the content! You can see similar: najlepszy sklep and here sklep online

Here is my website; sklep